Many people call the World Financial Group a pyramid scheme. Although I do not agree, I can see where they are coming from.

Welcome to my World Financial Group review.

Whether you are thinking of buying an insurance or investment product from WFG, or trying to decide whether joining them as an associate is a good business opportunity, this article will present the facts, along with my opinion, so that you are better-informed by the end of it.

I will walk you through the business model of World Financial Group, along with their sales tactics and recruitment methods. We will also take an objective look at the two extreme viewpoints that people tend to take of this company.

Without further ado, let’s dive right in now!

World Financial Group Review Summary

Product: World Financial Group

URL: http://worldfinancialgroup.com/

Creator: Hubert Humphrey

Product type: MLM company selling financial products

Price: $100 to join as an associate

Scam / Legit? : Legit

Recommended or not? : Not recommended

World Financial Group is an MLM (multilevel marketing) company that sells financial products like insurance and investment schemes. If you are already in the finance sector and have some background in this industry, this could work for you.

Otherwise, I cannot recommend World Financial Group as a business opportunity, especially from the way many of their associates tend to target inexperienced and vulnerable college students in trying to recruit them into their team.

Moreover, where a client’s financial health is at stake, I’m of the personal view that it is not responsible to run such a company on the MLM model.

What is World Financial Group

World Financial Group is a US based company that sells financial products like insurance policies, investment plans, savings plans, retirement plans, mutual funds, etc.

It is owned by AEGON, which is also marketed as Transamerica. They offer legit and very established financial instruments and products.

The agents selling these products under WFG are not employees of the company. They earn commissions when they sell those financial products.

The bigger difference between World Financial Group agents and your regular financial agents who are employed by insurance or investment companies is that the WFG agents rely heavily on recruiting new agents into the business to earn their income, and not just selling products.

Why people call World Financial Group a Pyramid Scheme or a Scam

A pyramid scheme is illegal because it does not have a solid, retailable product that people can purchase, solely from the position of a customer or client.

Basically anyone who gets involved in a company that is a pyramid scheme gets sucked into its compensation plan, where they will have to recruit more people in order to get back whatever they had invested in, and then possibly start earning.

World Financial Group is not a pyramid scheme, as it has legitimate products and services that its distributors, or agents, or associates (whatever you call them) can offer to their clients, without trying to recruit these clients into the business.

Why, then, is there the big hoo-ha about World Financial Group being a scam?

WFG’s recruitment drives target fresh grads and college students

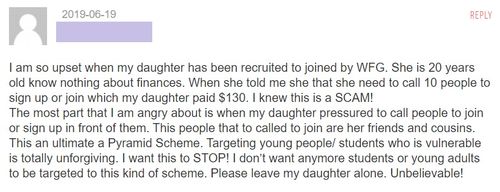

Unfortunately, we have seen too many cases of World Financial Group’s associates try to recruit very young people, mostly in their 20s, some fresh graduates, and even college students.

The pitch revolves around the business being able to provide the financial freedom, and flexible hours, so that they can live the life of their dreams.

Personally I cannot respect any company that allows its associates to exploit the innocence of young people, who have not yet gained enough life experience to understand what they are actually signing up for.

This is a reader’s comment from the website of financegeek.org.

There are too many cases like this, you can easily find them all over the internet. To me, it is manipulative, and totally unethical.

Of course, not every associate of WFG targets students and young people like that, but the name has been tarnished, the damage has been done by those who chase after the money at the expense of their own moral values and integrity.

Would you entrust your financial health to someone without financial background?

To become an associate of World Financial Group, you would have to complete two weeks of training, which will get you a license. This puts WFG on the right side of the law.

But this extremely low barrier to entry is really nothing compared to a proper financial advisor who not only received a tertiary education in the field, but would have accumulated tons of experience working in the financial sector.

If I were a client looking to invest, or draw out a retirement plan, or buy a life insurance policy, I’m pretty sure I wouldn’t be comfortable with someone who can pass off as a financial agent with barely two weeks of training.

This is the reason why I strongly feel that such an MLM model is completely wrong for the financial niche. It is something that requires professionalism and depth of knowledge, you can’t just model it after Amway, Herbalife, Avon, and the likes.

They target people on job boards

There have also been many cases of people who put up their resumes on job search platforms being targeted by World Financial Group.

They get calls from WFG associates asking them to come in for interviews, misleading them into thinking they are going for proper jobs, only to find out they have to pay to promote the company’s products.

Again, these are very shady tactics employed by WFG associates to try to recruit as many people as they possibly can into their teams, so that they qualify for commissions, as well as move up the ranks.

How to join World Financial Group

To become a World Financial Group associate, you simply pay $100, as an administrative fee.

This is non-refundable. If you change your mind even a few hours later, you will not be able to get your money back.

$100 may sound like a small amount to get started, but the real costs are not openly revealed.

You can be sure that your sponsor, or upline (basically the person who recruited you into the program) will be trying hard to sell you WFG products too, like life insurance, savings plans, etc.

Compensation Plan of World Financial Group

The rank at the entry level is called Training Associate. You are entitled to 25% commission if the qualifying requirements are met.

To start earning, you would first have to meet their 3:3:30 requirement. In any sequential 30-day period, you would have to make 3 sales, and recruit 3 partners on board.

As you progress through the ranks, commission percentages increase, up to a maximum of 65% at the Senior Marketing Director level. Only a very tiny percentage will be able to reach this rank, though.

And as you move up the ranks, the qualifying requirements also increase substantially, making it even harder for you to sustain those earnings.

Why this system fails

For a recruitment scheme to work and benefit everyone involved, as an associate, you have to target the right people to bring into the program – those who will stay on for the long term.

Someone without financial background would not have the expertise and skills needed to provide sound financial advice to clients. They are just not a good fit for the role at all.

Hence the drop off rate of associates would be extremely high.

You will be spending lots of time and effort trying to recruit people, only to see it all go down the drain when these new associates very quickly discover this is not going to work for them.

Who should join World Financial Group

World Financial Group is not for everyone, but I believe there is a specific group of people whom it can possibly work for – the professional financial advisors.

If you are already working in the finance sector, it may be worthwhile to explore World Financial Group as a means to increase your earning potential.

With the kind of value that you are able to offer to clients in terms of sound financial advice, I’m sure you will be able to sell the WFG products, and even have repeat customers.

At the same time, if you believe this is something that can work out, then you can invite your counterparts to join the team. They are in the same advantageous position to provide real value to clients. Hence they are likely to stay in this business, if it works out for them too.

Thus it’s a win-win for everyone.

Pros of World Financial Group

1. Legitimate financial products

WFG does sell very legitimate financial products like insurance policies, investment plans, savings plans, etc.

2. Can possibly work for people in the finance sector

If you are already in the finance sector, this opportunity could possibly increase your earning potential, if your colleagues in the industry are willing to give it a go too.

Then you would be able to build a team that is grounded and possesses the expertise to deliver great value to clients.

Cons of World Financial Group

1. Targets students and people looking for real jobs

The shady marketing gimmicks of World Financial Group are what have brought about their horrible reputation.

You can’t say it’s the company’s fault, but WFG also can’t shed all responsibility towards their associates’ doing, as these associates represent WFG.

2. Associates may not be well-equipped to provide financial advice

There is something very wrong at the core of this business model being used to sell financial products and services that require a certain level of expertise and knowledge, in order for customers not to be exploited.

It’s the exact reason why we do not find law firms and medical practices running on the MLM business model, it just cannot work this way.

3. Focus on recruitment

Just as with most other MLM companies, World Financial Group has a strong focus on recruitment in its compensation plan. Yet the plan rewards those high up in the echelons.

This means the new associates are running around doing all the hard work, getting other people to sign up under them, getting people to buy the financial products, only to have their uplines reaping the fruits of their labour.

Their own income is hardly anything substantial at all.

This is how MLM compensation plans are designed: to work for its founders and the few first generation associates who joined as the company was just starting up.

4. Family and friends start to shun you

As you follow what is taught by World Financial Group: to target your warm market, the friends and family around you are going to run away as if they are avoiding the plague.

Is World Financial Group Scam or legit?

World Financial Group is a legitimate MLM company. Many people call it a scam because of how their associates market the business opportunity in a manipulative and even dishonest manner.

Recommendation

World Financial Group is not the best way to find financial freedom. In fact, you would be lucky not to incur the wrath of people whom you tried to recruit into the company, as they would quickly discover it is not the great opportunity that they had been led to believe.

If you would give me the chance, I would like to show you how I am earning commissions without having to recruit a single person. I do not even have to engage in any form of face to face selling.

The business model I am using leverages on the internet to find targeted traffic to what I am promoting. Hence I do not have to convince people to buy, as they were already intending to buy.

If this sounds good to you, check out how it works exactly:

And for reading all the way to the end of the post, I believe you have it in you to make this work. Here is your FREE PDF Guide: 4 Simple Steps to Making Money Online. Fill in your details to claim it:

If you have any concerns or questions regarding this World Financial Group review, do comment below, and we will start a conversation from there.