Welcome to my Primerica insurance review.

Is it wise to buy insurance policies through MLM-ers? Do they even understand the products they sell? Does the company duly pay out its policies when they mature or when the policy holder dies?

As an earning opportunity, what are your chances of success with Primerica? Will the ins and outs of the insurance world be beyond you? Will you get any training that equips you with the knowledge to explain the policies to your clients?

We will answer all these questions and more in this in-depth review of the MLM insurance company that leverages on network marketers to sell its products and financial services.

Before I start, I need to make one thing clear: I am not selling Primerica. So whether you join or buy its products or not, it does not make any difference to me. My wish is that this article allows you to make an informed decision with consideration of various factors that I will be discussing.

Without further ado, let’s dive right in now!

- What is Primerica

- Product line

- Customers’ feedback

- How to join Primerica

- Compensation plan

- How Primerica may or may not work for you

- Pros and cons

- An alternative

Primerica Insurance Review Summary

Product: Primerica

URL: www.primerica.com

Creator: Arthur L. Williams Jr.

Product type: MLM (multilevel marketing) company that sells term life policies and other financial products and services

Price: $99

Scam / Legit? : Legit

Recommended or not? : Not recommended

Primerica mainly sells term life insurance through its network of insurance agents it recruits, who are compensated based on an MLM (multilevel marketing) model. Its policies will work great for you if you are young and do not have pre-existing conditions.

Like any MLM opportunity, it is not easy to find success because of the inherent nature of the business model. You need to actively recruit if you want to rise up the ranks to make a substantial amount of money. Otherwise, the time and effort may not be worth the while, hence a large percentage of agents give up.

What is Primerica

A brief background of Primerica

When Williams’ father passed away, his whole life insurance left the family uninsured. Some years later, a cousin introduced Williams to the concept of term life insurance, which is a much cheaper option, and simpler too. It opened his eyes to options in the insurance sector.

In the 1970s, the idea of term life insurance was almost unheard of. After a couple of stints with financial companies selling term life policies, Williams and 85 associates founded A.L. Williams and Associates in 1977.

With a strong vision to help his sales force become financially independent, the MLM model was adopted. It also committed to providing affordable policies to the middle-income people.

With the philosophy of ‘Buy Term and Invest the Difference’, the company grew into a giant in its niche, and in 1991 became Primerica Financial Services.

Primerica Product Line

Term life insurance

Primerica’s main product is its term life insurance policy, which has proven to be a much better option than whole life insurance for many people.

It is cheaper, and simpler to understand.

Basically term insurance provides pure protection for a fixed term, without any cash value.

Whereas whole life insurance not only offers protection, but a big chunk of what you pay goes into a form of savings, albeit at a very low rate of returns.

Hence it makes sense to buy a cheaper term policy, and invest the difference into some financial products of your choice.

One downside to Primerica is its higher pricing when compared to similar term policies sold by other companies. I guess it is understandable, considering the commissions that have to be paid out to not just the agent who sold the product, but also to the team of uplines, on top of profits to the company.

It is fairly straightforward to buy Primerica’s term life insurance if you are young, and have no pre-existing conditions. That means you are not expected to die anytime soon.

Otherwise, the price can go up quite a bit, depending on the situation of your health conditions.

Also, there have been quite a number of complaints by long-time customers that the rates skyrocket once you go beyond a certain age. This is covered in a later section below.

Other products

Besides term life insurance, Primerica also sells other insurances like those for auto, home, and long term care.

Its financial services include investment accounts, legal and identity theft services.

Primerica Customers’ Feedback

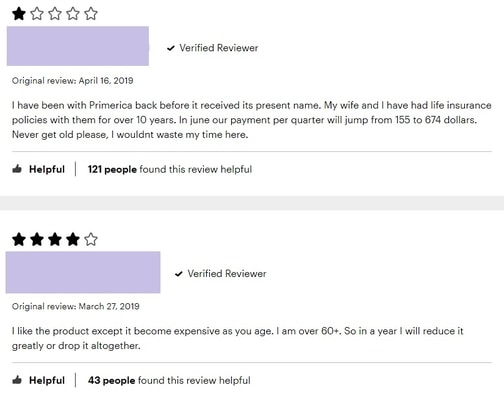

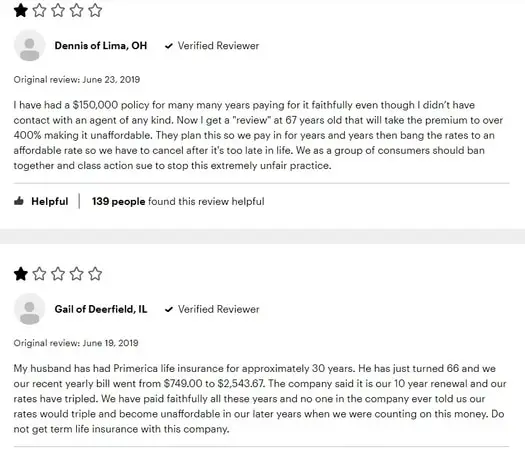

As far as I can tell, young customers mostly gave positive reviews of Primerica’s life insurance. But older folks get a rude shock by how much the prices go up once they hit a certain age, usually 60+.

Take a look at these, just a handful of the many that are on the internet.

My personal take on this: the higher the risk to the company, the higher the cost will get. So you would have to weigh the price you pay against the amount that your family will be insured for.

When it gets not worth the while anymore, putting your money in some investment vehicle and making sure your will is done up properly may just be the better option.

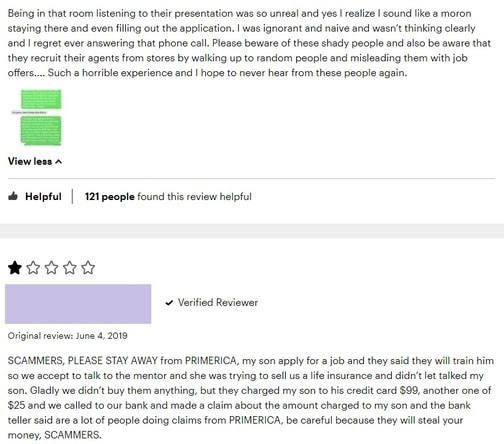

Another category of complaints has to do with how aggressive the insurance agents of Primerica are in recruiting others into the business.

Every Primerica’s insurance agent is different, and obviously not everyone will be so shady in trying to make sales and finding people to recruit. But the number of complaints on just one review platform that I searched is enough cause for concern.

Primerica Business Opportunity

How to become a Primerica Distributor

$99 is for the membership, and then $25 for each month of access to their members only Primerica Online website. It includes lots of support resources, as well as a Primerica replicate website that is personalized to contain your unique link.

A noteworthy point is that there is training that lasts at least 3 months, leading up to a certification that you would have to pass. Since you need a license in order to sell Primerica’s insurance and investment products.

Training is definitely a good thing, otherwise I doubt the company would ever get any customers at all, if their agents do not have some basic knowledge of the products they are selling. Remember, even people without any background in the finances sector can do this. So it is important to get their agents certified.

The down side is that before you get certified, you cannot start selling their policies. This means there is no chance of making any money in the first three months.

How to make money with Primerica

Just as with any other MLM company, there are two main ways to make money with Primerica: sell their policies and other services to earn product commission, and recruit people into your team to earn through their sales and other commissions and bonuses.

Product commission

Though the compensation plan of Primerica is not available on their official website, I gleaned some information on the internet by some of its agents, so here it is:

For every term life policy that you sell, it’s a 25% commission of the first year’s premium. For instance, if the first year premium for your client’s policy is $800, you make $200.

I think this is quite neat, except that it may not be that easy to make consistent sales, month after month.

Moreover, you will hardly get any repeat customers for such big purchases like life insurance. Which means you will have to keep looking for new clients, and convince them that Primerica’s life insurances are better than what they already have.

One unique feature about the Primerica is its Fast Start Award Program, which you will get to benefit from if you allow your sponsor to promote the life insurance to your warm market (family, friends, co-workers, etc.) and 4 life policy transactions (including your own) are made.

Why not? Since during the training period you will not be allowed to sell anything anyway.

Well, there are good and bad to this. The good thing is you get to actually see sales pitches in action, so called on the job training. It will be valuable only if your sponsor is a seasoned marketer who knows his or her stuff well, and has good communication and persuasion skills.

The bad thing about the program is that you could potentially lose income from sales of insurance policies to your sponsor. After introducing your warm market to your sponsor, who else are you going to sell to?

Why, your downline’s warm market, of course. You will be encouraging the people you recruit to send potential clients in their warm market to you during their training period, and that is how you will be able to find potential clients to pitch to.

That is, provided you are able to recruit anyone into the Primerica business in the first place. And that brings us to the next section on recruiting.

Recruitment

In the Primerica compensation plan, once you have recruited three direct downlines into your team, you become a Senior Representative, qualifying for 35% product commissions on life policies, as well as 10% overrides (you earn 10% commission when the people you directly recruit make sales on life policies).

Beyond the Senior Rep level, earning potential increases even more as you build your team and continue making more sales.

Though it sounds promising, the hard truth is only a very small percentage of MLM participants will find success. The vast majority (99%, from a report found on the Federal Trade Commission’s website) do not profit from their MLM businesses.

Why is that so?

Let us examine this in more detail in the next section.

Why Primerica may not work for you

Payment plan favors the higher ranks

First and foremost, MLM compensation plans typically see the bulk of earnings passed up to those high up in the ranks.

Primerica is no exception. Get to the top, and not only does your product commission increase in percentage, the overrides will increase drastically as well.

In other words, once you build up a huge team, you will have people working for you, hence you get to reap the fruits of others’ labor.

That is the financially free lifestyle that is sold to every new MLM participant. But only the rare individual will ever get there. The vast majority are disheartened by the lack of results, that is why so many people give up.

Time-intensive

With Primerica, you are selling a high-priced product, something that affects people’s lives. It is not about scented candles or cruelty-free cosmetics.

These are big decisions that affect their families too. You won’t expect to clinch the deal in one sitting for most cases. Unless you are selling the policies very aggressively, which may not be the best thing for the relationship with your customers.

Hence this is a business that is going to consume a lot of your time, even if you are only looking for a side income.

On the same note, it is not very feasible to bring your Primerica business online. People do not just buy an insurance policy off some website. They may go online to look for information, but the actual buying won’t take place there and then.

The nature of the product requires face to face interaction to build trust, and help the customer understand the values that it will bring to their financial health.

Thus it is almost impossible to scale up the business using internet traffic.

No repeat customers

Yes, life insurance can be seen as a necessity.

But consider any person you approach, chances are he or she would already have a life policy with another company. You would have to take on the uphill task of convincing them to switch it over to Primerica’s term policy.

Even if they actually do, that’s it. You would have to look for yet another potential customer all over again.

Most people do not make it

When it comes to qualifying for the license to sell life insurance with Primerica, only 48,535 reps made it, out of 303,867 new recruits in 2017.

These figures are from Primerica’s annual report 2017.

Another point of interest is that the average number of sales reps increased by 9,448 from 2016 to 2017. And yet the number of newly licensed reps was 48,535.

This means that more than 39K reps had dropped the business.

And we’re not even talking about earnings yet. Among those who were in the business, many could be struggling and not seeing much sales and recruitment.

To round up this article, let me recap and summarize the pros and cons, before I finally make my conclusion.

Pros of Primerica

1. Established company

Having been around for more than 40 years definitely says something about this giant in the insurance industry.

2. Products that work

It is not a scam. Primerica actually pays out in cases of death of the policy holder.

3. Great training and support for its representatives

The licensing training course prepares its insurance agents to be competitive in what they do. Some may say 3 months of training is nothing compared to what full time, regular insurance agents have to go through, I will say it is better than nothing.

4. You do not have to buy a policy yourself

To join the business opportunity, you simply sign up, and take the training for the licensing. There is no requirement for you to purchase a Primerica product yourself, which is great.

Cons of Primerica

1. High pricing

Primerica products have to be higher than many competitors running on simple retail, in order to support its own payment plan.

2. Product is not for everyone

If you have pre-existing health conditions, or are beyond a certain age, then Primerica may become too expensive, such that it is a bigger liability than the protection it can offer.

3. Focus on recruitment

Though its product is great and it works, and there is no one stopping you from just doing sales of the life policies, the earning potential lies in recruitment, which boosts not just your sales commissions, but also the overrides.

4. Most representatives do not make money

On Page 61 of the Primerica 2017 Annual Report, the average monthly rate of new policies issued per licensed sales rep is quoted as 0.21. And that works out to be 2+ policies sold by each rep (on average) in the entire year?

Imagine the hours that would have been put in, and the countless rejections faced, just to make this tiny side income.

If making 2 sales per year is the average, how many reps would have gone away empty handed, and with a hole in their pockets?

5. Family and friends start to shun you

Since the marketing strategy taught to Primerica reps is to actively search out their warm market, you can be sure family and friends are going to keep their distance.

Is Primerica Scam or legit?

Primerica is a completely legitimate insurance company running on the MLM model, with great term life policies that can work for many people.

Except it won’t be easy to make sales, as this niche requires face to face selling which can be difficult to scale up, unlike many other MLM businesses (Natura, Perfect, Quanjian, Infinitus and Karatbars, to name just a few).

An Alternative

As with all MLM companies, Primerica’s earning potential lies in recruitment, which is precisely where the difficulty lies.

Now, allow me to humbly show you a completely different model, one that I created my online business with.

There is no recruitment involved, and no registration fee to start promoting any company. It also means I can choose to work with as many companies as I like, all at the same time.

The payment plan is clear and straightforward: I earn commissions based on the amount of sales I drive to the company. It’s fair and square, nobody will exploit the hard work of my labor.

The best thing is: I can scale my business without having to spend more time, because it allows me to leverage on internet traffic, to reach ready buyers who are looking for exactly what I am promoting.

If this sounds good to you, do check out the details in another post, by clicking on the button below:

And for reading all the way to the end of the post, I believe you have it in you to make this work. Here is your FREE PDF Guide: 4 Simple Steps to Making Money Online. Fill in your details to claim it:

If you have any concerns or questions regarding this Primerica insurance review, do comment below, and we will start a conversation from there.